If your property tax is paid through your mortgage, you can contact your lender for a copy of your bill.

Sangamon county parcel search pdf#

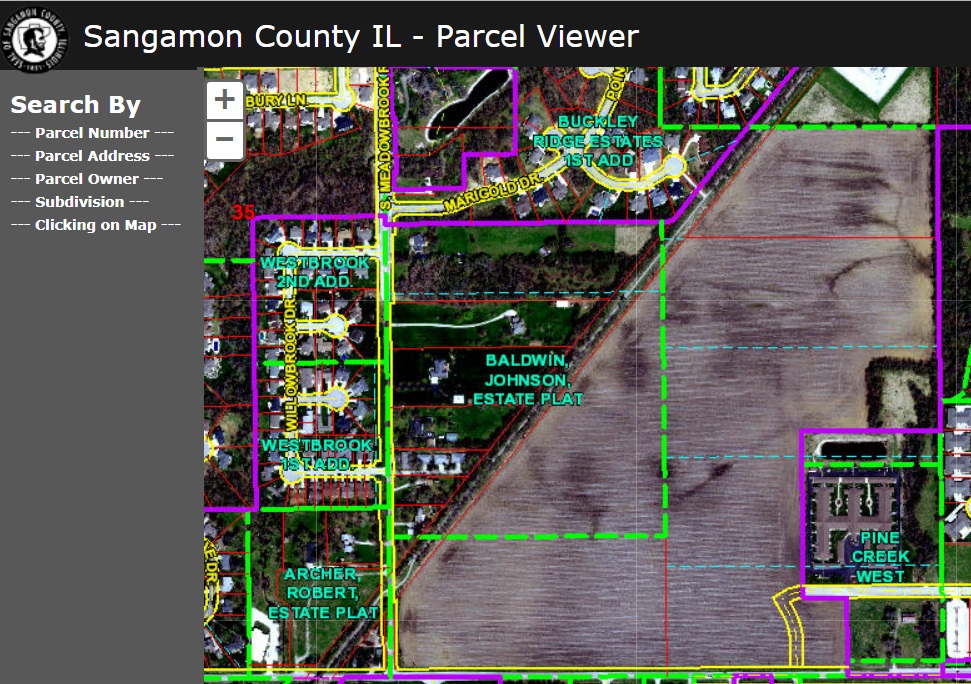

pdf image and are available by e-mail or copied to your flash drive.If you qualify for the Illinois Property Tax Credit, you will need your Property Index Number, sometimes called "parcel number" or "permanent index number." This number is located on your county tax bill or assessment notice (for property tax paid on your principal residence during the tax year for which you are filing your return). Printed or digital copies of the aerial view or line only parcel maps are available. We have public use computer terminals in our office with inquiry access to the Property Tax System and the GIS. Our office also maintains digital parcel line records of the entire county, which may be viewed online on the Sangamon County GIS. A request to remove a name from the tax record must be accompanied by a copy of the death certificate and a recorded document. In the case of an authorized agent conducting business on behalf of the owner, legal written documentation such as a Power of Attorney, Letter of Guardianship or Testamentary, or a Will is required as evidence of authorization.Īny request for change of name must be made in writing, or in person, and accompanied by substantiating documentation such as a court order, marriage license, will and inventory, or other legal document. Written, faxed or in person requests are required from the property owner or their authorized agent. Procedures for requesting a change of mailing address for assessment change notices and tax bills are as follows: Requests made by telephone are not accepted. It is the property owner's responsibility to notify our office of the new mailing address for assessment change notification and tax bills when refinancing or a release of mortgage is recorded. We also assist property owners with various application forms for.

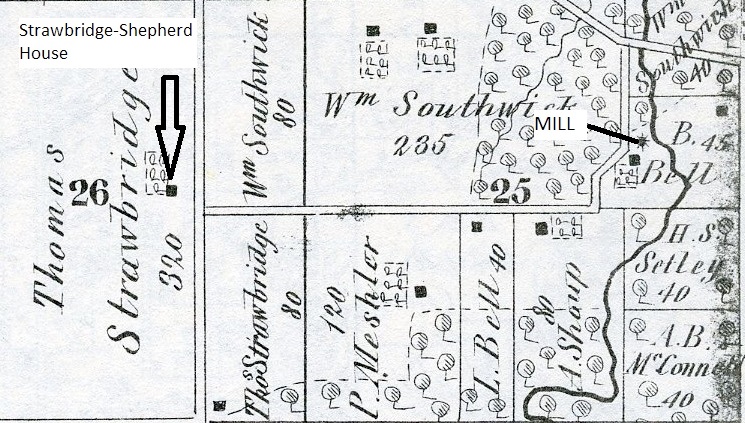

By state law, recorded and approved surveys changing boundaries or establishing new parcels, subdivisions or lots are acted upon in the year following the year of recording. The deed contains a section that instructs our office to whom and where to mail future tax bills. During the closing of the real estate transfer, the deed is signed by the seller authorizing the transfer of their interest in the real estate. (First Installment of Property Taxes were due on Friday June 3, 2022.) Property tax bills were mailed on April 29th with a due date of June 3rd.

The average length of time between the recording of the deed and the change of the ownership record in our office is 4 - 6 weeks. Owner Name Parcel Number Address City Action CLARK STEVE & KARIN 14-31.0-377-037: 900 CLOCK TOWER DR SPRINGFIELD : 901 CLOCK TOWER 14-31.0-376-036: 901 CLOCK TOWER DR SPRINGFIELD : WOOD STREET ENTERPRISES LLC.

Sangamon county parcel search free#

The Supervisor of Assessments also serves as the clerk to the Board of Review and chairman of the Farmland Assessment Review Committee.ĭeeds recorded in the Office of the Recorder are transmitted electronically to our department. Free Sangamon County Property Records Search Find Sangamon County residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. There are approximately 11,306 parcels in Piatt County at this time. The following is a list of websites you can visit to assist in finding out more. We also assist property owners with various application forms for exemptions and special assessments, as well as explaining the technical details of the property tax laws as they apply to assessing in Illinois and assisting with assessment complaint documents. Click here to go to the Piatt County Tax Search Website where you can find real. The Sangamon County Circuit Clerk and County Clerk offices have records.

Our office maintains records of ownership, tax bill mailing address, property (site) address, legal description, sales data, and assessment values (as reported to us by the local township assessors) for all the parcels of land in Sangamon County.

0 kommentar(er)

0 kommentar(er)